Navigating the Cannabis Surge: Market Insights from the Heartland

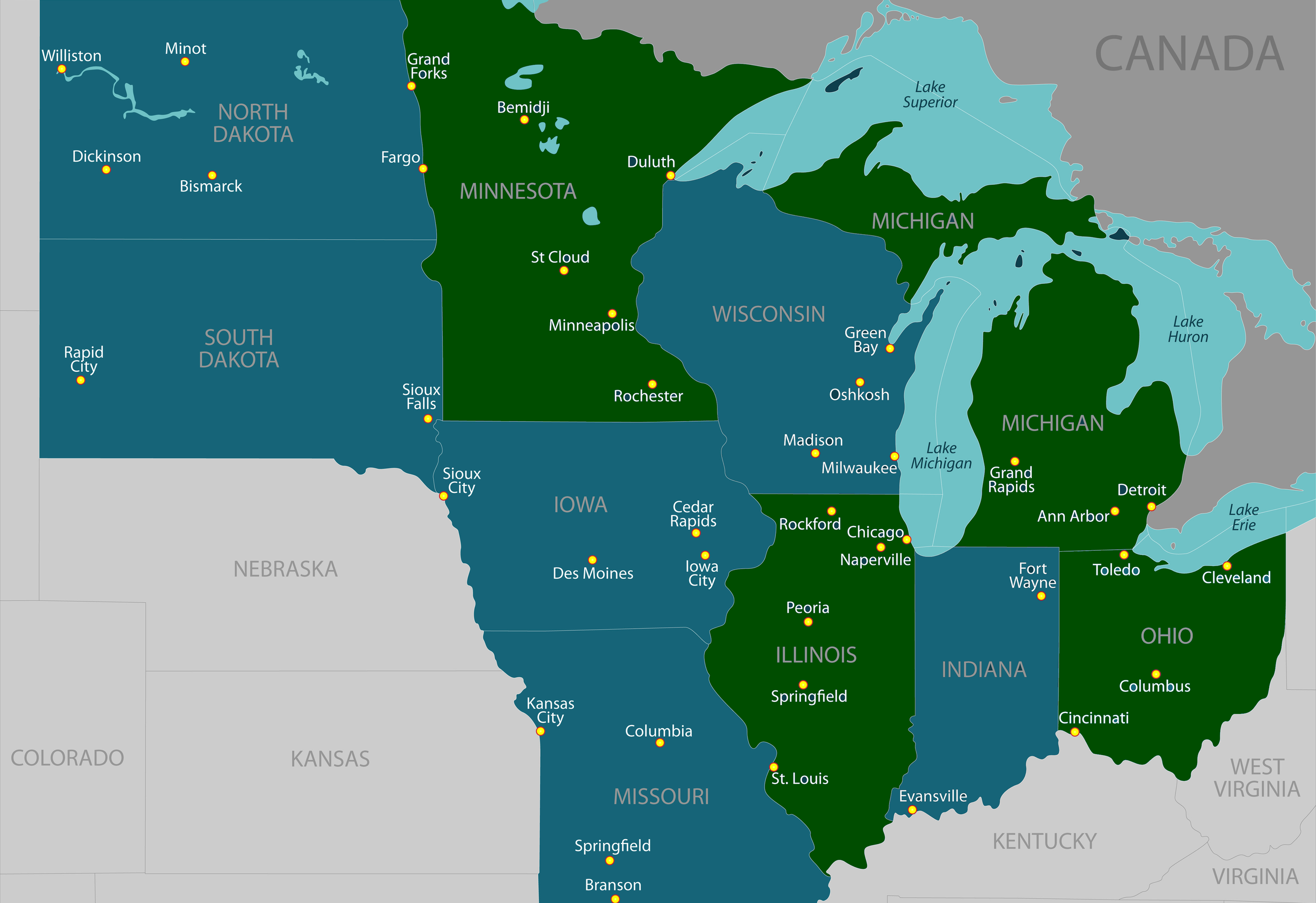

The Midwest (including the states of Illinois, Michigan, Minnesota, and Ohio) has emerged as a pivotal region in the dynamic landscape of cannabis. These states have navigated through the complexities of legalizing and regulating cannabis with each bringing its unique approach to the industry. Collectively, these states are shaping the future of cannabis in the Midwest, presenting growing opportunities in this rapidly evolving industry.

Illinois

The legal cannabis industry in Illinois has witnessed a remarkable surge in growth during fiscal year 2023, and these positive trends are anticipated to extend into 2024. Notably, fiscal year 2023 achieved total retail sales exceeding $1.5 billion, contributing significantly to the state's financial resources, with tax revenue amounting to $451.9 million, which exceeded the revenue the State received from alcohol sales. 2023’s sales volume of cannabis products also experienced a notable increase, reaching nearly 45 million units. An interesting facet of this growth is that approximately one-quarter of all cannabis sales were attributed to out-of-state residents, indicating the industry's capacity to attract a broad customer base.

A total of 28 new retail licenses across the state were granted. A noteworthy proportion of these newly established businesses are owned by military veterans, reflecting a commitment to social equity within the industry.

For 2024, the Illinois Cannabis Regulation Oversight Officer (ICROO) has outlined ambitious objectives. Beginning on January 7th of the upcoming year, the Department of Agriculture (DoA) will initiate the application process for both (1) transport organization licenses and (2) infuser licenses. Transporters will be able to transport cannabis on behalf of cannabis business establishments or a licensed community college vocational program between licensees (not to consumers), while infuser licenses will be able to incorporate cannabis or cannabis concentrates to produce cannabis-infused products. A non-refundable application fee of $5,000 is required for both, with Social Equity applicants receiving a 50% fee waiver with approval. If awarded the license, an infuser will pay another $5,000 fee, while a transporter will have to pay $10,000 and both will have similar stipulations regarding Social Equity fee waivers. The state also has plans to recruit and integrate eight additional inspectors and processors, with the explicit goal of expediting the licensing process for individuals and businesses.

Michigan

In a manner similar to that of Illinois, albeit with even more pronounced success, Michigan's cannabis industry is experiencing a flourishing period marked by significant growth and development. Since the legalization of adult-use cannabis in the state, Michigan has quickly become a vibrant hub for the cannabis business and a top 3 cannabis-selling state across the country, only trailing California and Colorado. In September, the state had over $275 million in total sales. Michigan's cannabis industry is thriving thanks to a favorable regulatory framework with low entry barriers and modest taxes. Its strategic location bordering cannabis-prohibited states like Wisconsin and Indiana makes it a critical hub for addressing unmet demand in the region.

Michigan's embrace of a robust regulatory framework has cultivated a competitive market that prioritizes quality and safety. The state has followed an unlimited licensing approach, which has been conducive to a thriving ecosystem of both large-scale operators and small craft businesses. Nonetheless, it is important to note that not all municipalities have embraced cannabis retailers, with several opting to prohibit their presence. Additionally, certain municipalities have imposed limitations on the total number of licenses that can be granted. However, these restrictions have not impeded the overall expansion of the industry, as evidenced by the issuance of a total of 91 new licenses across various categories in just September alone.

With continually evolving regulations and a dedicated customer base, the future of Michigan's cannabis industry is still very much promising. In early October, the governor signed a bipartisan bill that permits licensed cannabis businesses to engage in commercial transactions with tribal cannabis entities, effectively expanding and diversifying an already robust marketplace. In hoping to give more access to the customer, a rising cadre of recreational enterprises in Michigan, spanning from outdoor cannabis cultivation facilities to micro-businesses, are increasingly offering guided tours to interested consumers. These tours offer a firsthand educational experience, providing insight into the growth, harvesting, and processing of cannabis plants. Michigan has become a top model for responsible and equitable cannabis market growth in the Midwest and beyond.

Minnesota

Minnesota's Governor, Tim Walz, enacted a bill on May 30th, ushering in the legalization of adult-use cannabis in the state, a measure that officially commenced on August 1. The Office of Cannabis Management, tasked with the responsibility of overseeing licensing, has yet to release any official documentation regarding the application process. The state's initial endeavors have been less than promising, as the newly appointed director of Minnesota's nascent cannabis regulatory agency resigned before assuming her role.

The state is now compelled to allocate time towards crafting regulatory frameworks and granting licenses to entities involved in the cultivation, processing, and retailing of cannabis. Consequently, the establishment of cannabis retailers beyond tribal dispensaries in Minnesota may not transpire until the beginning of 2025. Tribal nations have gained an early advantage in this emerging industry, with three Minnesota tribes recently commencing adult-use sales. This has granted them at least a one-year head start on sales over state-licensed cannabis retailers and other operators. Minnesota boasts a diverse array of 16 distinct license categories for potential cannabis businesses, a number exceeding that of any other U.S. state. Given this multiplicity, engaging expert advice may be necessary to choose the most appropriate license type.

These license categories encompass:

Retail

Delivery

Manufacturing

Cultivation

Wholesale

Transportation

Testing Facility

Event Organizing

Mezzobusiness

Microbusiness.

Nonrefundable application fees are based upon the specific license type and can be as low as $250 for delivery licenses and as high as $10,000 for cultivators. Furthermore, initial license fees are contingent on being awarded a license and are between $500-$20,000. The state is actively engaged in the recruitment of personnel for its department, and it will duly publish official announcements to provide updates on the ongoing progress.

Ohio

In contrast to the initial three states mentioned, Ohio has yet to formally legalize adult-use cannabis, but is looking to do so in the upcoming elections scheduled for November 7th. This significant change hinges on Issue 2, an initiative slated to be featured on the November ballot. If passed, Issue 2 would institute a framework for the legalization and regulation of adult-use cannabis in Ohio, targeting adults aged 21 and above.

The potential shift towards recreational cannabis has evoked a range of responses, including notable opposition from entities such as the Ohio Fraternal Order of Police, the Ohio Association of Chiefs of Police, and Ohio Governor Mike DeWine. While these opposing voices contribute to an ongoing and spirited debate, recent polling data from Fallon Research underscores a noteworthy trend. According to the poll, an impressive 59% of Ohio residents express support for the legalization of recreational cannabis, while only 32% oppose, signifying a significant shift in public sentiment toward embracing the plant for adult recreational use.

Since the inception of Ohio’s current medical cannabis market through September, 2023, total product sales in the State have amounted to $1.48 billion. This impressive figure is complemented by the sale of 18,007,562 units of manufactured cannabis products, underscoring the robustness of the industry within the state. Presently, Ohio boasts an impressive active patient base of 182,068 individuals enrolled in its medical cannabis program. However, as previously discussed, a notable proportion of adult-use cannabis sales in Michigan can be attributed to residents of Ohio, who frequently cross state lines driven by concerns over prices and the administrative complexities associated with maintaining their registration within Ohio's cannabis program.

As Ohio grapples with this pivotal vote, the outcome of the upcoming election stands to greatly influence the state's cannabis landscape and potentially usher in a new era of cannabis policy within its borders.

Ready to Become a Licensed Cannabis Business Owner in the Midwest?

Seize this opportunity and position yourself as a leader in the thriving Midwest cannabis market! Gain valuable insights to increase your chances of success by contacting a Global Go expert today.